Islamic finance: Unlocking hidden capital for economic growth

It is an axiom that when entrepreneurship develops, the economy grows. Another axiom is that when there are more entrepreneurs who pay taxes, the state prospers. However, the institution that ensures the integration of billions of dollars into Uzbekistan's taxable economy – Islamic finance – has not yet developed. This is the topic of discussion by the field expert Iskandar Tursunov.

Currently, the existing financial system does not have sufficient resources to meet all the needs of individuals, entrepreneurs, and self-employed people when financing their business activities or ensuring working capital. This is primarily due to limited financial resources and opportunities.

Overcoming these barriers by developing economic inclusivity and an efficient financial system is essential.

Certain segments of the population do not have access to financial assistance from banks or microfinance organizations. The main reasons for this are:

- Non-compliance with the requirements set by banks;

- Limited resources in microfinance organizations;

- Religious beliefs preventing the use of financial services.

Islamic finance plays a significant role in ensuring stable economic development, meeting the financial needs of various population segments, and reducing the burden on the existing financial system.

It is asset-based, allowing financial resources from both domestic and international markets to be effectively directed for the benefit of the state and society. The asset-based nature of Islamic finance eliminates unnecessary financial requirements for its users.

According to the Islamic Finance Development Report (ICD-REFINITIV):

- In 2022, Islamic finance assets grew by 11%, reaching $4.5 trillion.

- This figure is expected to reach $7 trillion by 2027.

Such rapid growth of Islamic finance assets increases its significance in the global financial system. It not only promotes financial inclusion but also plays a crucial role in creating a fair and stable economic environment for the state and society.

Regulation and development prospects of Islamic finance

In recent years, Uzbekistan has taken significant steps toward developing Islamic finance. Specifically:

- International cooperation: Work is underway to establish legal foundations in cooperation with international Islamic finance institutions.

- Microfinance regulations: On July 27, 2024, the Central Bank of the Republic of Uzbekistan issued a decree (No. 3536) approving the "Regulations on the Provision of Islamic Financing Services by Microfinance Organizations." According to this regulation, microfinance organizations can now finance clients through products such as Salam, Mudarabah, Musharakah, Murabaha, Istisna, and Ijarah.

Although there is a legal framework for Islamic microfinance, it is essential to quickly resolve the following issues:

- Taxation matters: Islamic finance operations differ from traditional financial systems. The absence of mechanisms for fair and just taxation complicates the financing process.

- Resource mobilization: There are insufficient legal mechanisms to attract investors and financial resources, hindering the full utilization of existing opportunities.

- Establishment of a centralized council: It is crucial to form a special council to coordinate Islamic finance operations and define strategic directions.

Support from relevant ministries and agencies in addressing these issues and ensuring responsibility and proactive actions in executing tasks is essential.

Demand for Islamic finance

In recent years, there has been growing demand for Islamic finance. However, it is beneficial to take a closer look at research findings and studies.

Some research findings:

In 2019, the UN conducted a study on the need for Islamic finance, its legal foundations, and development prospects in Uzbekistan. This study showed significant market potential for Islamic finance in the country. Results from a 2020 survey confirm this:

- 38% of entrepreneurs and 56% of individuals rejected traditional bank loans;

- If Islamic finance institutions were established, 61% of entrepreneurs and 75% of the population would be willing to use their services.

Additional information: Research conducted at the end of 2023 and the beginning of 2024 in Kazakhstan revealed a very high demand for Islamic finance products. Specific figures include:

- Islamic deposits: $5.98 billion;

- Buy Now, Pay Later (BNPL) services: $485 million;

- Unsecured Islamic loans: $2.18 billion;

- Islamic vehicle financing: $2.26 billion;

- Islamic mortgages: $6.21 billion.

The total demand amounted to $15.35 billion, clearly demonstrating the enormous market potential for Islamic finance products and services in Kazakhstan.

Potential demand in Uzbekistan

Uzbekistan's population is almost twice that of Kazakhstan, suggesting that the potential demand for Islamic finance in Uzbekistan could be much higher. Current estimates indicate that the demand for Islamic finance products and services in Uzbekistan may be at least $10–15 billion.

If stable legal foundations, financial literacy, infrastructure development, effective use of technology, and efficient marketing strategies are implemented, this demand could increase several times, contributing to the development of the domestic market and attracting international investments.

Providing working capital through Islamic finance

Approximately 50% of Uzbekistan's population lives in rural areas, primarily engaged in farming, livestock, horticulture, entrepreneurship, self-employment, and craftsmanship. In these sectors, working capital plays a crucial role, and its shortage can slow down production processes. Here, Islamic finance appears as an effective solution to provide working capital.

For example, a Salam contract offers farmers the opportunity to finance their harvests in advance. This helps overcome financial difficulties and allows them to focus entirely on the production process. At the same time, investors assist in bringing products to market and organizing sales in domestic and international markets. This process benefits both farmers and investors, contributing to the creation of a fair and stable economic system.

This approach plays a significant role not only in reducing poverty and ensuring economic stability but also in strengthening food security and social justice.

Taxation mechanism for Islamic finance

In many countries, the principle of tax neutrality is applied to Islamic finance. According to this principle, Islamic banking operations are subject to the same tax burden as traditional banking operations. When taxing, the economic substance of the transaction is considered rather than its legal form, meaning the actual economic results are paramount.

To comply with Sharia requirements, additional documentation and processes are needed in Islamic finance. Exempting these additional processes from tax burdens is vital to ensuring a fair and stable tax system.

For example, in 2020, the Philippines introduced legal foundations and tax neutrality for Islamic finance. With a population of 119 million, 6.4% of whom are Muslims, this experience shows that the development of Islamic finance is not just about the number of Muslim citizens, but about effectively utilizing global economic opportunities and striving to create a fair and inclusive financial system.

Resource Issues in Islamic (Micro)Finance

Islamic microfinance institutions can carry out their functions effectively by mobilizing available resources. The following measures will help utilize domestic market resources:

- Establishing Islamic bank branches to attract deposits and ensure liquidity;

- Cooperation between traditional banks and Islamic microfinance organizations: Mobilizing resources and solving financial issues based on Mudarabah and Musharakah mechanisms in compliance with Islamic finance principles;

- Issuing Sukuk securities: Establishing legal foundations to attract both international and local investments;

- Focusing on the development of social Islamic finance to create legal foundations for Waqf property rights: Introducing the "Cash Waqf" model and effectively utilizing Waqf resources;

- Creating Islamic P2P platforms: Developing a system for attracting investments and providing microfinancing through crowdfunding and online platforms;

- Developing the Takaful system: Developing insurance products in compliance with Islamic law and supporting Takaful operators.

Conclusion

To improve the effectiveness of Islamic finance, ensure its fair and transparent operation, and quickly resolve existing challenges, it is appropriate to apply effective cooperation methods among ministries and agencies during the World Trade Organization accession process. This approach can be used for the introduction and development of Islamic finance.

A list of financial institutions and organizations providing Islamic finance services, the services they offer, and documents confirming their compliance with Sharia principles should be posted on the relevant ministries or agencies’ official websites. These measures will increase transparency and trust in the process of introducing and developing Islamic finance.

Iskandar Tursunov, Expert in Islamic Economics and Finance

Related News

12:16

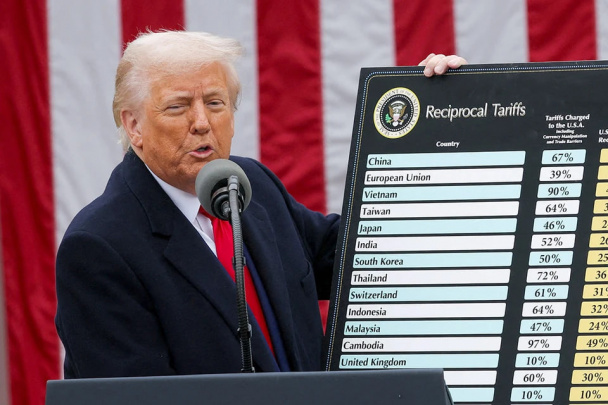

Uzbekistan may feel secondary effects of Trump’s global tariff policy

15:50 / 03.04.2025

Trump imposes 10% baseline tariff on all imports, raising economic uncertainty

19:17 / 02.04.2025

Uzbekistan sees 20% increase in budget revenue in Q1 2025

17:57 / 01.04.2025