Large real estate asset in Bukhara sold to a company owned by Artel

In the city of Bukhara, state property on 17.6 hectares was sold for 110 billion soums. The buyer is a company that was established 6 days before the auction, and its founder, who is linked to Artel, received a tax credit of 23 billion soums within 6 months.

Photo: E-AUKSION

A large state asset located in the city of Bukhara, belonging to the former “Bukhorotex” JSC, was sold at an online auction for 109.9 billion soums. This property has 17.6 hectares of land and 115 thousand square meters of buildings and structures.

“The buildings and facilities belonging to the declared bankrupt enterprise have been empty for more than 10 years and were given in 2015 with the condition of making investments at zero purchase price. However, due to non-fulfillment of investment obligations, the contract was canceled in 2021,” the E-auction announced on October 10.

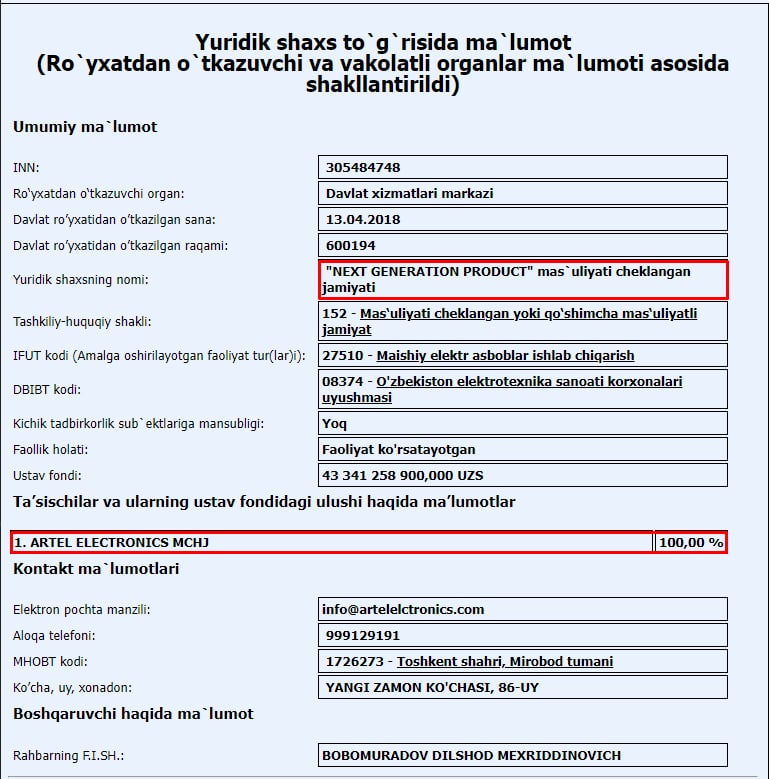

State property was sold to “Bukhara Next Generation Product” LLC. It is noteworthy that this enterprise was established on October 4, 2022.

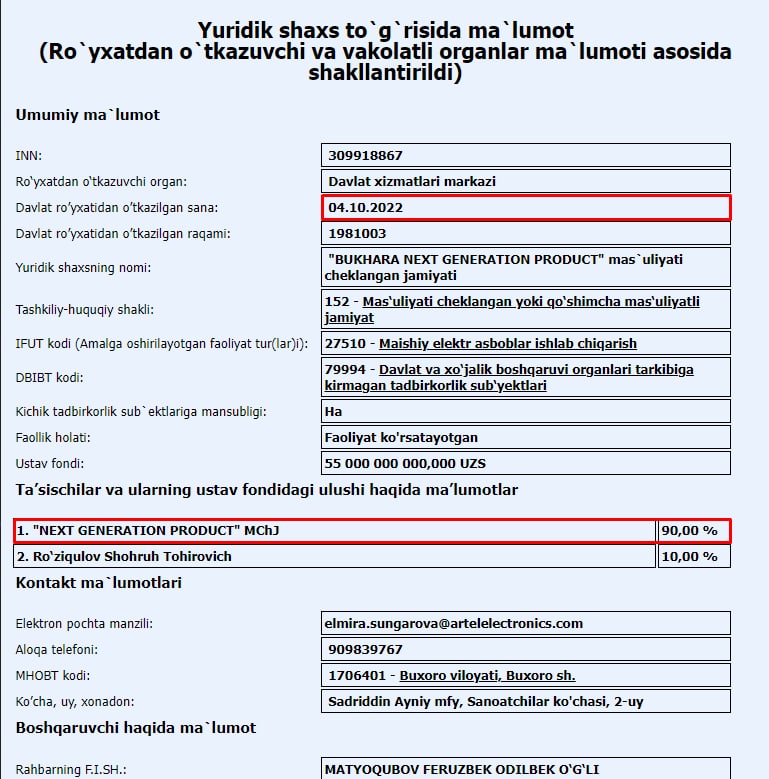

90% of this company belongs to “Next Generation Product” LLC. In turn, 100% of “Next Generation Product” LLC belongs to “Artel Electronics” LLC. The Artel enterprise is related to Tashkent city khokim Jakhongir Artikhodjayev.

Big tax breaks

According to the public information of the State Tax Committee, in the first half of this year, a number of companies, 100% of which are owned by “Artel Electronics” LLC, were given a large amount of tax benefits. Specifically, as of July 1, the following enterprises have been provided with huge tax breaks:

• “Next Generation Product” LLC – 23.1 billion soums from VAT;

• “New Profi Technology” LLC – 2 billion soums from social tax, 20 million soums from personal income tax;

• “Quality Device” LLC – 12.4 billion soums from VAT, 524 million soums from property tax, 476 million soums from profit tax, 188 million soums from land tax, 18 million soums from personal income tax;

• “Quality electronics” LLC – 14.1 billion soums from VAT, 36 million soums from personal income tax;

• “Prime Electric Engineering” LLC – 3.9 billion soums from VAT, 157 million soums from property tax, 22 million soums from personal income tax, 4 million soums from profit tax, 3.2 million soums from social tax;

• “Trust Electronics” LLC – 88 million soums from profit tax, 20 million soums from personal income tax;

• “Techno Continental” LLC – 24.1 billion soums from VAT, 594 million soums from profit tax;

• “Future Industry Systems” LLC – 9.7 million soums from personal income tax;

• “Artel Technical School” LLC – 24.1 billion soums from VAT.

The information service of the State Tax Committee informed Kun.uz that the aforementioned “Next Generation Product” LLC was given VAT benefits because it produces products that have no analogues in Uzbekistan.

“The enterprise is a manufacturer of household electrical appliances such as gas stoves and water heaters. Exporters of these products have been provided with VAT exemption for the realization of goods (services) for the construction of model low-cost housing,” the committee explained.

Related News

14:06 / 14.11.2024

Uztemiryolcontainer’s 35% stake sold for 200 billion UZS to Cotton Logistics

17:27 / 25.10.2024

UAE's Bond Investments acquires Poytakht Bank for $10 million

15:07 / 24.10.2024

Uzbekistan ends 'zero' price sales of state assets under new law

16:11 / 15.10.2024