Growth of state budget revenues slowed down sharply

In 2023, state budget revenues increased by 14.8%. For comparison, even in 2020, when the pandemic occurred, budget revenues increased by more than this. Revenues from land, property and personal income taxes increased significantly last year. In turn, turnover tax has decreased, while income tax revenue has increased by only 8.5%.

Photo: Kun.uz

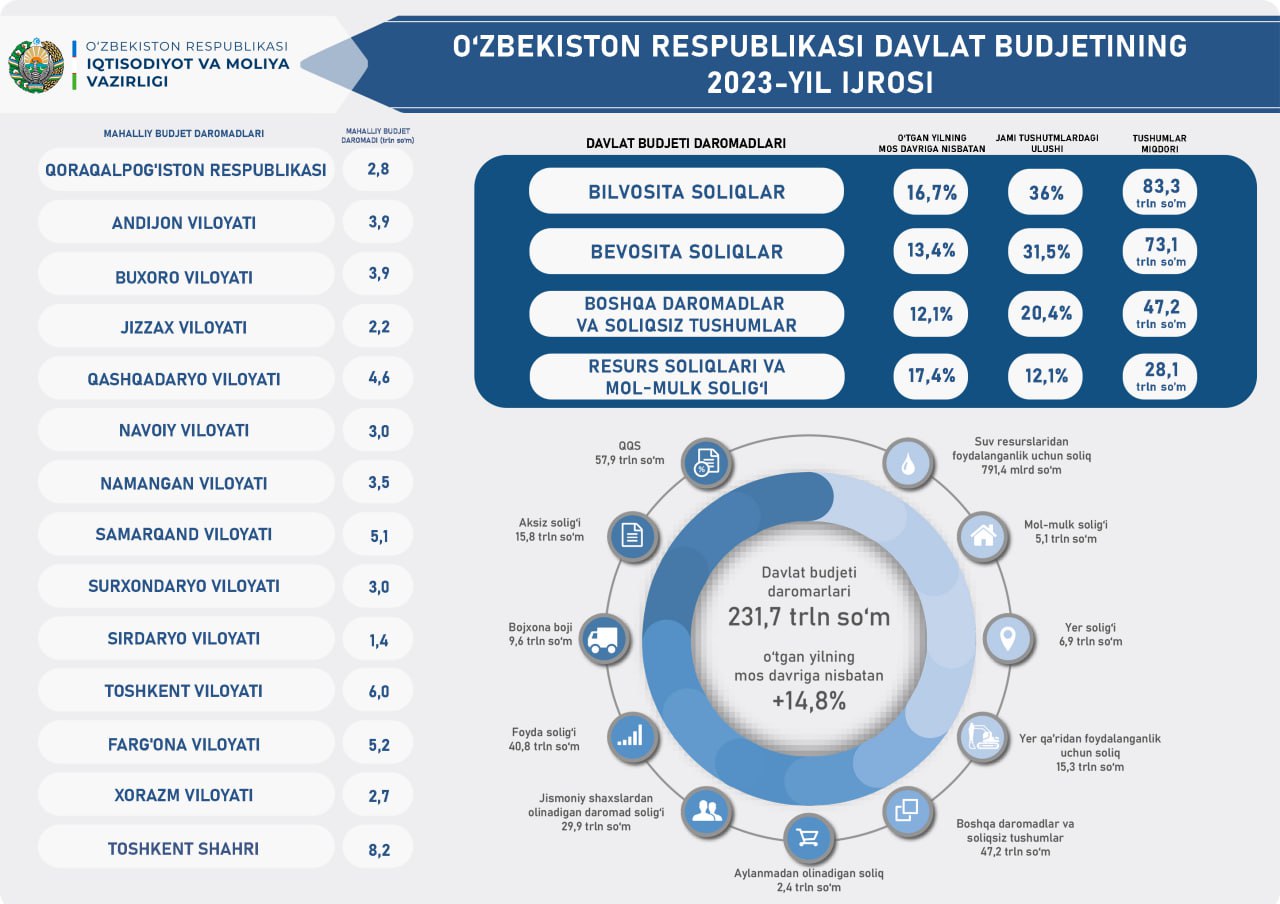

In 2023, the revenues of the State budget of the Republic of Uzbekistan amounted to 231.7 trillion soums. This was reported by the Ministry of Economy and Finance. Cost details have not yet been released.

According to the Ministry, state budget revenues in 2023 increased by 14.8% compared to 2022.

This means that the growth of budget revenues has slowed down. Revenue growth was 22.5% in 2022, 23.9% in 2021, and 18.5% in 2020, when the pandemic began.

Based on the average of the official exchange rates set by the Central Bank for the first and last banking days of 2023, last year's state budget revenues were equal to $19.6 billion.

Taxes accounted for 79.6% of revenues, and tax-free receipts and other revenues for 20.4%.

Last year, among the types of taxes, the highest growth was observed in the customs duty - revenues from this direction increased from 5.7 trillion soums in 2022 to 68.4% in 2023, reaching 9.6 trillion soums.

Revenues from land tax increased by 30.2% (up to 6.9 trillion soums), property tax revenues by 27.5% (up to 5.1 trillion soums), personal income tax revenues by 23.0% (up to 29.9 trillion soums), excise tax collections increased by 17.0% (up to 15.8 trillion soums).

Among the types of taxes, turnover tax and profit tax are characterized by low indicators. AOS revenues decreased by 4.0% (up to 2.4 trillion soums), while the growth of income from profit tax was lower than the official inflation rate - 8.5% (up to 40.8 trillion soums).

Related News

18:30 / 08.11.2024

Uzbekistan to raise property and water taxes in 2025

17:34 / 08.11.2024

Government introduces VAT rebates to boost hospitality and tourism sectors

18:18 / 31.10.2024

Uzbekistan to abolish excise tax on mobile communications

17:18 / 31.10.2024